Retirement program drains school coffers

Last updated 4/16/2002 at Noon

Sisters School District will have to pay an extra $107,000 next year to keep up with current obligations to the Public Employee Retirement System (PERS).

That payout is part of a statewide funding crisis that has left state agencies, cities, fire and police departments scrambling to cover a ballooning unfunded liability.

PERS offers public employees hired in 1996 or before a guaranteed 8 percent return on retirement investment. Employees can also choose to put money into a more aggressive account that floats with the market and does not have the guarantee.

Many employees put some money in both accounts.

In 1984, the Oregon legislature voted to allow a "money match" from public employers for employee investments, based on value at the time of retirement. However, the employer is much more restricted in the kind of investments allowed, and could therefore not expect the same kind of return.

The money match provision was voted in the same year the legislators voted themselves onto the system.

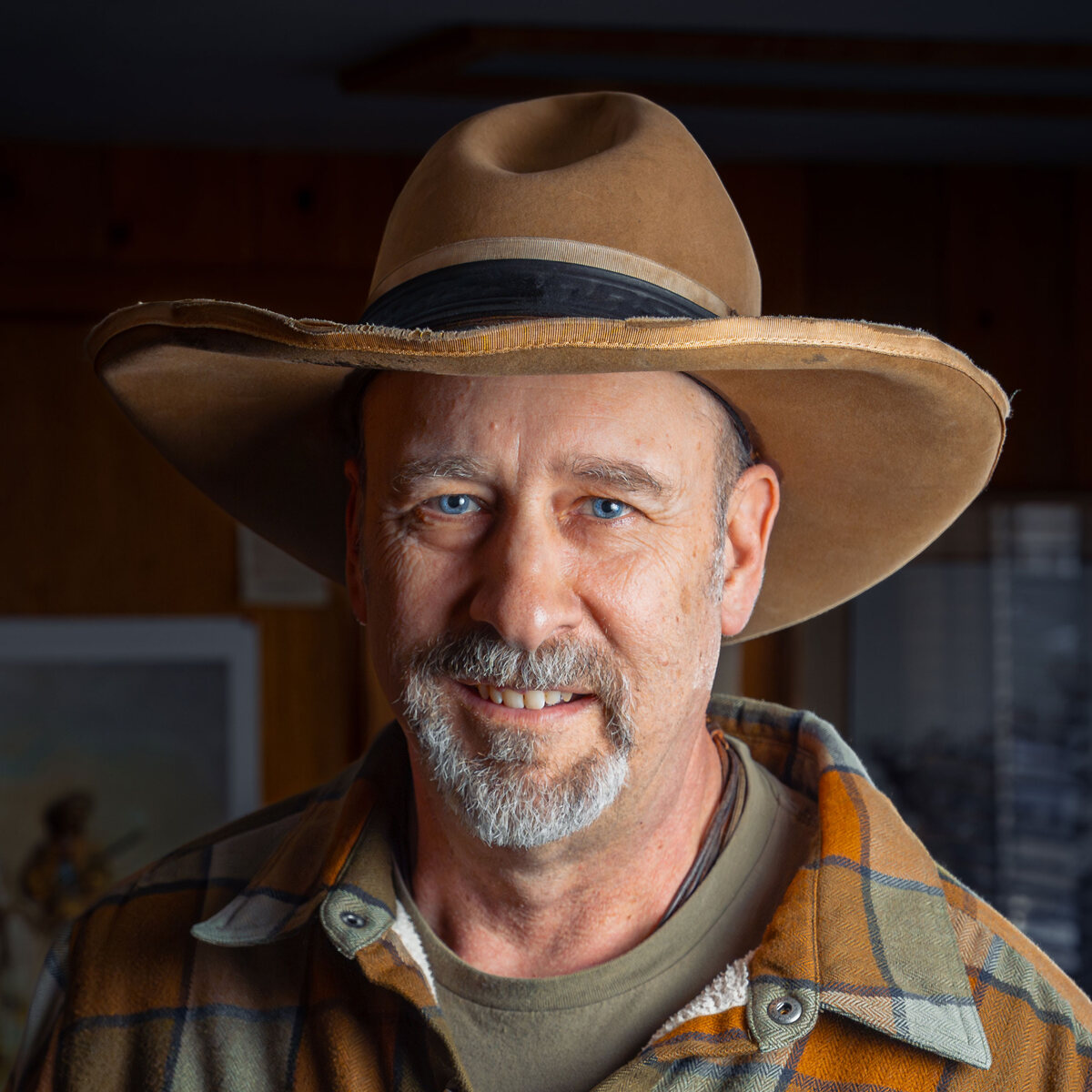

According to school superintendent Steve Swisher, the system worked for a long time, as "even in recession years (PERS) was hitting pretty close to 8 percent with its investments."

But investment income has not kept up in recent years and employers, including the Sisters School District, were required to pay more to meet the 8 percent guarantee -- even though PERS income was way below that figure.

In 1999, Sisters School District payed 12.73 percent to keep up; estimated 2000 rates are 15.21 percent.

The projected $107,000 PERS shortfall translates to approximately 2.3 teaching positions, based on a "rookie" salary, according to Swisher.

Statewide, the funding gap was $680 million in 1999 and grew to $1.7 billion in 2000. The deficit could, according to some estimates, grow to over $3 billion in another year.

School employees are the largest group in PERS, according to an Oregonian report on March 18. The Oregonian story noted that "benefits now add 38 percent of salary to the total compensation of Oregon public school employees, according to audit figures from the Oregon Department of Education. The biggest slice of fringe benefits is the money school districts contribute to the Public Employees Retirement System for employee pensions."

The Sisters School board is considering a plan to refinance the PERS liability with bonds at 7 percent. That would save the district about $22,186 next year.

Reader Comments(0)